COVID-19 has only little structural impact on global crop production – this is one of the most important takeaways from the annual agri benchmark Cash Crop Conference, which took place from June 15th to June 22nd, due to Corona the first time as a web meeting. More than 100 international scientific and commercial partners gathered to discuss the latest results from international benchmarking, as well as strategic challenges in global crop production.

Commodity markets only marginally affected by Covid19 so far

Based on an agri benchmark online forum with our international partners, as well as a presentation by Klaus-Dieter Schumacher (independent consultant), we assume that – unlike in other agricultural sectors such as livestock or horticulture – the production of broadacre crops will not be significantly affected by the current crisis. In particular, Mr. Schumacher stated: “I expect global commodity trade to continue to grow. Other than in some specialty products, the production potential of many importing countries in grains and oilseeds is simply too limited to allow for a significant import substitution.” Such a strategy has been promoted by some politicians in order to avoid long value chains, which are considered to be vulnerable during crises such as Covid19.

In the US, however, the Coronavirus has led to a massive dip in fuel and ethanol consumption. Ethanol plants have therefore stopped producing and corn stocks have increased significantly. Consequently, corn prices will be under pressure in the short run. A similar situation is underway in Brazil, where the decline in ethanol demand has prompted sugar mills to switch to sugar production instead of ethanol, ultimately causing sugar prices to go south.

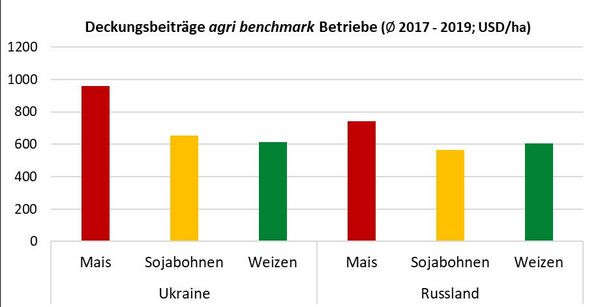

Situation in the EU not consistent – farms in Russia and Ukraine perform well

Due to regular yields and mostly flat farm gate prices, 2019 was a relatively normal year for most growers. In the EU, the picture was more varied: Typical farms in France, the UK and Spain saw a drop in profits, while German, Danish and Swedish farms had better results than in 2017 and 2018. For the USA, however, the fairly positive condition is only true due to an increase in coupled subsidies (approx. $160/ha). These subsidies are meant to compensate growers for losses resulting from the trade conflict with China. Canadian producers have also suffered due to China’s massive reduction of canola imports.